All tipsters worth their salt record their profit and loss; it’s a staple of the industry and rightly so. After all, the aim of a tipster is to make his/her followers a profit.

But as I’ve burrowed deeper into the world of Twitter Tipsters, I’ve noticed a worrying trend. Instead of focusing on the long run, there is an obsession with monthly performance.

“What’s wrong with that?” – I hear you ask.

Let me demonstrate with an example from the glorious world of Economics – the subject I studied at university.

Richard Thaler* was interested in how people would invest their money when he altered the way their returns were displayed.

He devised an experiment in which the subjects were given a choice of two retirement funds: a riskier one with higher expected returns or a safer one with lower expected returns; known as Fund A and Fund B respectively.

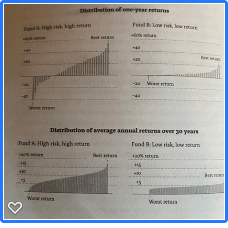

In one version, subjects were shown the returns of both options annually; in the other, they were shown the average return over a thirty-year horizon. The image below shows the graphs that were used in the experiment. Note that the data is exactly the same.

The key to this experiment is that Fund A is the “correct” choice as it yields greater returns. In a world where everyone makes perfectly logical decisions, Fund A would be chosen unanimously and the way in which the data is shown would make no impact. But that is not reality, as the experiment shows.

90% of the subjects that were shown the thirty-year distribution chose Fund A. In stark contrast, just 40% of subjects who were shown the returns annually selected Fund A; the majority chose the fund with the lower return – a staggering outcome, but why did this happen?

In short, it’s due to a phenomenon known as “myopic loss aversion”. This is where investors focus too strongly on the short term, leading them to react too negatively to losses at the expense of long-term benefits.

The same problem exists within gambling when monthly profit & loss becomes the focus. A tipster who’s in a losing position for the month going into the last few days is more likely to take a risk to try and salvage a profitable month; a risk they wouldn’t have taken if they were in healthy profit. The concept of “Loss Aversion” means that a sudden loss of £100 hurts more than the equivalent gain of £100 gives pleasure.

Using the same logic, a tipster who enters the final days of a month with a slim profit is likely to take less risk to maintain their position. Normally, this will be disguised with the quote “I can’t find any value today” or words to that effect.

The aim for all punters is to make long term profit; but focusing on the short term encourages behaviour that makes that aim even harder to achieve.

Every bet should be considered in isolation. If a tipster is profitable in the long run, a bet they deem optimal on the 1st of a month should also be placed on the 31st.

Monthly tracking has it’s uses and shouldn’t be disregarded entirely – but a profitable month should not be the priority.

Let’s get back to focusing on the long term!

*Thaler, R (2015) ‘Misbehaving: The Making of Behavioural Economics’